Introduction to Business Credit

In the realm of business https://commonlawblog.com/ finance, the concept of credit plays a pivotal role in facilitating transactions, managing cash flow, and fostering growth. Understanding how businesses utilize credit to record their financial activities is essential for effective financial management and decision-making.

Understanding the Concept of Credit in Business

What is a Business Credit?

Business credit refers to the ability of a company to obtain goods or services with the promise of payment in the future. It essentially represents trust extended to a business entity by its suppliers, lenders, or creditors, allowing them to make purchases on credit terms.

Importance of Business Credit

Maintaining a positive credit standing is crucial for businesses as it enables them to access essential resources without immediate payment, thereby preserving cash flow and facilitating operational efficiency.

Types of Business Credit

Businesses can access credit through various means, each tailored to meet specific financial needs and objectives.

Trade Credit

Trade credit involves purchasing goods or services from suppliers with an agreement to pay at a later date, typically within a specified period, such as 30, 60, or 90 days.

Bank Credit

Bank credit encompasses loans and lines of credit extended by financial institutions to businesses for various purposes, such as financing expansion, purchasing equipment, or managing short-term cash flow needs.

Installment Credit

Installment credit allows businesses to acquire assets or equipment by making periodic payments over a predetermined period, including principal and interest.

Revolving Credit

Revolving credit provides businesses with a line of credit that can be used repeatedly up to a certain limit. Payments are made based on the amount borrowed and can fluctuate depending on usage.

How Businesses Use Credit for Recording Transactions

Basics of Double-Entry Bookkeeping

In accounting, businesses use a double-entry bookkeeping system to record financial transactions accurately. This system ensures that every transaction affects two or more accounts, maintaining the balance of the accounting equation (Assets = Liabilities + Equity).

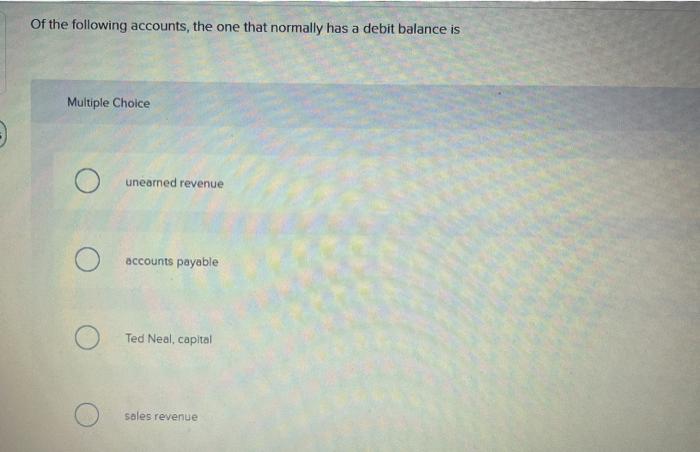

Debit and Credit in Accounting

In double-entry bookkeeping, transactions are recorded using debits and credits. Debits represent increases in assets and expenses or decreases in liabilities and equity, while credits indicate the opposite.

Examples of Recording Transactions with Credit

When a business purchases inventory on credit, it records an increase in inventory (debit) and an increase in accounts payable (credit). Similarly, when making a payment on a loan, the business debits the loan payable account and credits the cash account.

Advantages of Using Credit in Business Transactions

Flexibility in Payments

Using credit allows businesses to manage their cash flow more effectively by spreading out payments over time, aligning expenses with revenue generation.

Building Business Credit History

Timely repayment of credit obligations helps businesses establish a positive credit history, which can enhance their credibility with creditors and lenders, enabling access to more favorable financing terms in the future.

Leveraging Cash Flow

By utilizing credit for purchases, businesses can conserve cash for other operational expenses or investment opportunities, leveraging their cash flow to maximize growth potential.

Risks and Challenges Associated with Using Credit in Business

Overindebtedness

Excessive reliance on credit can lead to overindebtedness, where businesses struggle to meet their financial obligations, resulting in liquidity issues and potential bankruptcy.

Interest Payments

Borrowing funds through credit facilities often entails interest payments, which can increase the overall cost of financing and impact profitability if not managed effectively.

Impact on Credit Score

Failure to repay credit obligations on time or defaulting on loans can negatively impact a business’s credit score, limiting its ability to access credit in the future and potentially jeopardizing its financial health.

Strategies for Effective Credit Management in Business

Establishing Credit Policies

Businesses should develop clear credit policies outlining terms of trade, credit limits, and procedures for monitoring and managing credit risk to mitigate potential losses.

Monitoring Credit Usage

Regular monitoring of credit usage and outstanding balances enables businesses to identify potential issues early and take corrective actions to avoid financial distress.

Negotiating Favorable Terms with Creditors

Maintaining open communication with creditors and negotiating favorable terms, such as discounts for early payment or extended credit periods, can help businesses optimize their credit arrangements.

Conclusion

In conclusion, the prudent use of credit is essential for businesses to effectively manage their finances, support growth initiatives, and maintain liquidity. By understanding the various types of credit available and implementing sound credit management practices, businesses can leverage credit to their advantage while mitigating associated risks.